Truist Business Line of Credit

Truist Business Line of Credit provides entrepreneurs and small business owners with a flexible financial tool that offers easy access to funds for managing cash flow, handling unexpected expenses, and seizing new opportunities without the hassle of applying for a new loan each time. This financial solution acts as a safety net, enabling businesses to navigate financial challenges confidently in today’s dynamic market landscape.

Features and Benefits

- Flexibility: Truist Business Line of Credit offers flexibility in accessing funds, allowing businesses to use the credit line as needed for various financial requirements.

- Convenience: With quick access to funds, businesses can address cash flow needs promptly and efficiently.

- Cost-Effective: The line of credit helps businesses save on costs by providing a convenient source of funding without the need for repeated loan applications.

- Financial Cushion: It serves as a cushion for businesses, enabling them to invest in growth initiatives, manage cash flow fluctuations, and handle emergency expenses effectively.

- Competitive Rates: Truist Business Line of Credit offers competitive interest rates, making it a cost-effective financing option for businesses.

- Transparent Fees: The line of credit comes with transparent fee structures, ensuring clarity for businesses regarding the costs associated with borrowing.

Eligibility Requirements for Truist Business Line of Credit

Eligibility Requirements for Truist Business Line of Credit

The Truist Business Line of Credit has specific eligibility criteria that businesses need to meet in order to qualify for this financial tool.

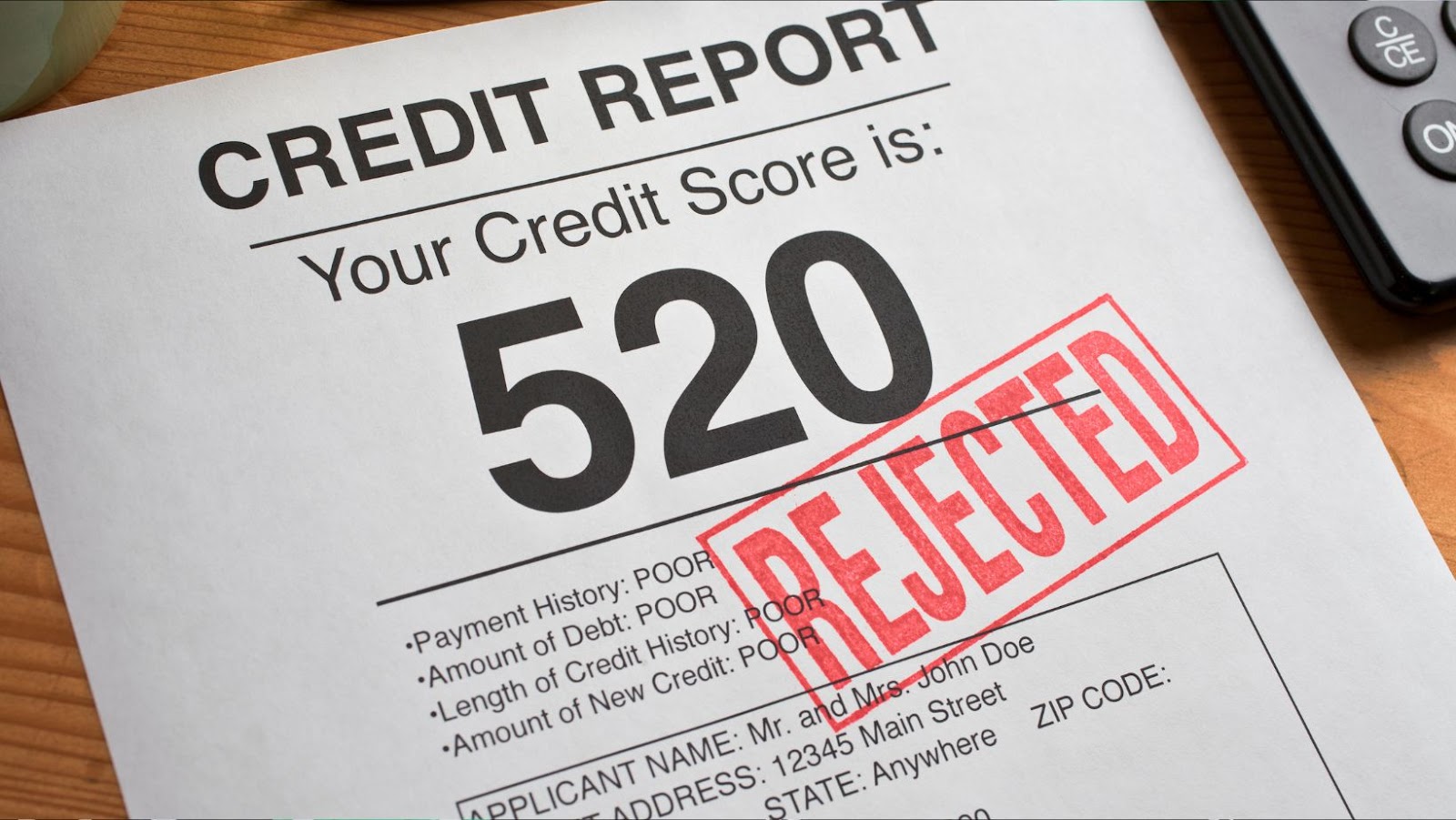

To be eligible for the Truist Business Line of Credit, businesses typically need to have a solid credit score and a positive financial history. Lenders often look for a minimum credit score, which can vary depending on the institution. A good credit history demonstrates the borrower’s ability to manage debt responsibly and increases their chances of approval for the line of credit.

Businesses applying for the Truist Business Line of Credit will need to provide certain documentation to support their application. This may include but is not limited to, business financial statements, tax returns, bank statements, business licenses, identification documents, and a detailed business plan. Having all the necessary documentation prepared and organized can streamline the application process and improve the likelihood of approval.

Applying for a Truist Business Line of Credit

Applying for a Truist Business Line of Credit

When applying for a Truist Business Line of Credit, the process involves several key steps to ensure a smooth and successful application.

Step-by-Step Application Process

- Initial Assessment: The first step in applying for a Truist Business Line of Credit is to conduct an initial assessment of the business’s financial health and creditworthiness. Lenders typically evaluate factors such as credit score, financial statements, and business performance.

- Gather Documentation: Prepare all necessary documentation required for the application process. This may include financial statements, tax returns, bank statements, business licenses, identification documents, and a detailed business plan. Having these documents organized and up-to-date can streamline the application process.

- Submit Application: Once all documentation is in order, submit the application for a Truist Business Line of Credit. Ensure that the application is filled out accurately and completely to avoid any delays in the review process.

- Review and Approval: After submitting the application, the lender will review the information provided and assess the business’s eligibility for a line of credit. This review process may include verifying the accuracy of the information submitted and conducting a credit check.

- Acceptance and Terms: If the application is approved, the business will receive an offer outlining the approved credit limit, terms, and conditions of the line of credit. Review the offer carefully, and if acceptable, proceed with accepting the terms to activate the line of credit.

- Maintain a Strong Credit Score: A strong credit score is essential when applying for a Truist Business Line of Credit. Make timely payments, keep credit utilization low, and monitor credit reports regularly to ensure a healthy credit profile.

- Organize Financial Documentation: Ensure all financial documentation is up-to-date, organized, and readily accessible. This includes financial statements, tax returns, and any other relevant documents that may be required during the application process.

The Truist Business Line of Credit emerges as a versatile financial solution for entrepreneurs and small business owners, offering a range of benefits such as flexibility, competitive interest rates, and transparent fee structures. By providing quick access to funds and tailored financial support, it serves as a reliable safety net for managing cash flow, seizing opportunities, and handling unexpected expenses effectively.